Our October 2025 Budget in Percentages | Family of Four

October kicked off with a fun surprise: a ~$1,900 car bill for brake repairs. Starting off the month with a big unexpected expense seemed to open the floodgates for everything else, we found ourselves thinking, “Well, we’re already over budget… what’s a little more?”

By the end of the month, we ended up being only about $1,300 over. We managed to offset the car bill a bit by spending less in a few other areas, but this was definitely a month of higher-than-usual spending.

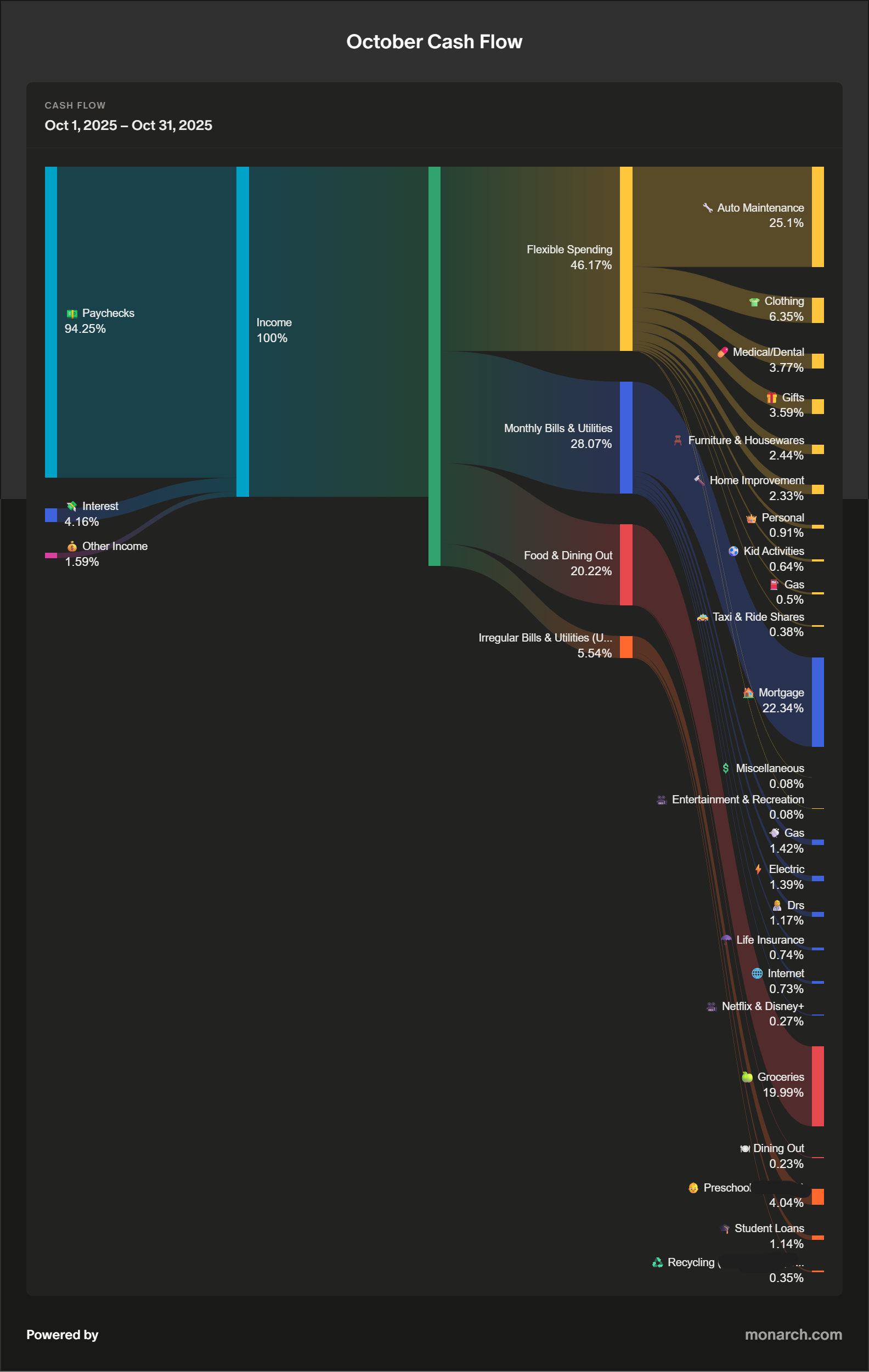

Cash Flow Overview

Thanks to the car repair, we spent more than we brought in this month. We do have a savings fund for car expenses, but for now, I’m holding off on moving any money to see if we can make up the difference in November. I’m not overly optimistic, we’re hosting Thanksgiving and the holidays are approaching, but we’ll see, you never know! We still have enough in checking to get us to the end of November, I’ll reassess moving money around at that point.

In addition to the car expense, we spent more than usual in a few other categories:

Clothing: I’ve been on the hunt for new jeans, I needed new sneakers, and was dress shopping for an upcoming wedding. H also needed some “fancier” shoes. A few of these items will be returned, so some of the money spent will come back to us.

Gifts: A few birthdays and early Christmas shopping.

Electric: This bill was over our budgeted amount again and I’m not sure if it’s just that time of year, if we’re using more electricity than last year, or if prices have gone up (or it’s all of the above). I’ll continue to keep tabs on it and if we keep going over it might be time to bump up this category.

Netflix/Disney+: Our Disney+ subscription amount went up by a few dollars so I had to readjust the budget. It was a small amount but these little price increases across different categories can add up quickly.

Highlights

Savings rate: 0%. The car bill wiped out our ability to save this month, which makes me extra glad we put money aside in September!

Top three spending categories:

Car Maintenance (25%)

Mortgage (22%)

Groceries (20%)

Our mortgage went down slightly (thanks, escrow adjustment!), and groceries held steady from last month, which honestly surprised me since we re-upped several pricier staples (vitamins, supplements, dish soap in bulk).

Irregular Bills: Recycling was the only irregular bill to hit this month. We pulled that from our sinking funds and also added money for future upcoming bills.

Reflections

Unexpected expenses can throw everything off and I’m grateful that we’re at a point where something like this feels like an inconvenience rather than a crisis. It’s taken a long time to get to this point though!

That said, it’s funny how easy it is to justify small splurges once a big expense happens. After spending nearly $2,000 on the car, I definitely caught myself thinking, “What’s another $30 for this gift?” or “$40 for these clothes?” It’s a good reminder that little things add up too.

Halloween, on the other hand, barely showed up in our budget. We bought some paint to make a DIY gravestone from scrap wood, but that was about it. We didn’t even hand out candy this year (oops!). Costumes were made from things we already had:

I was Cookie Monster (blue fleece hoodie + DIY eyes on a headband + DIY cardboard cookies taped to my fleece).

Mike was a cookie (an oversized frisbee covered in a beige sheet with construction paper chips taped to the sheet).

The girls were cats (face paint, black clothes, cat ears and tails).

Simple, fun, and mostly free. Next year we do plan on actually having candy available though!

Looking Ahead to November

Next month we’re hosting Thanksgiving with my mom and sister, plus a visit from Mike’s parents earlier in the month. That means higher grocery spending, but we’ll likely have plenty of leftovers (and fewer grocery trips afterward).

Once November wraps up, I’ll reassess whether we need to move money from savings to top off our checking, or if we can naturally balance things out by month’s (or year’s) end.