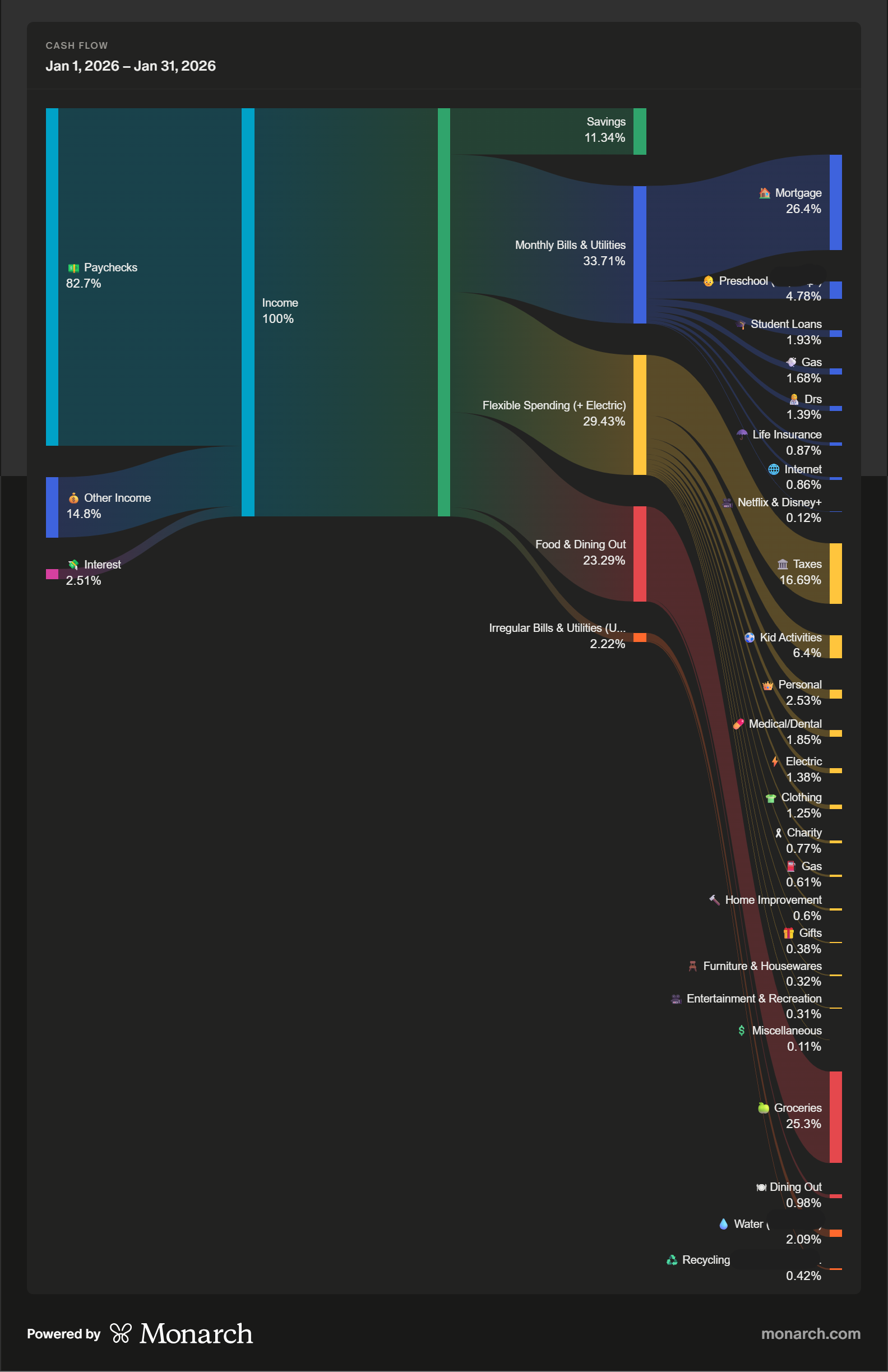

Our January 2026 Budget in Percentages | Family of Four

We spent about $200 more than we intended to in our Food & Dining Out category in January. A big winter storm hit at the end of the month and we stocked up on non-perishable food and water in case our power went out or our pipes froze. Thankfully, neither happened. We’ve had frozen pipes in the past and really did not want to repeat those experiences. Just like December, the vast majority of this money went towards groceries, with only about $60 spent on dining out all month.

We were under budget in our Flexible Spending (+ Electric) group category by almost $400, which covered the Food & Dining Out overage, and even allowed us to save a little bit for the month.

The Other Income that you see in the chart below is a transfer from my business bank account to cover quarterly taxes.

Highlights

Savings rate: 11.3%

Top spending categories:

Mortgage (26.4%)

Groceries (25.3%)

Quarterly tax payments (16.7%)

Kid activities (6.4%)

Irregular bills that hit:

Water (2.1%)

Recycling (0.4%)

Reflections & Looking Ahead

What changed most compared to a “normal” month?

I started prioritizing retirement again, reducing how much I pay myself from my business so I can make monthly contributions to a Roth IRA. We lowered our food and flexible spending categories to make room for this shift.

What felt good this month?

Using interest from our HYSA (which houses our emergency fund) to offset the shifts in our budget. Although the interest we earn in the HYSA doesn’t fully cover what I’m putting in the Roth, it definitely helps lessen the impact of having a little less direct income.

Is there anything we’d tweak for the future?

I caught and cancelled a forgotten subscription. The payment showed up, I immediately emailed the company, and they were able to cancel the order. Though I usually put this kind of stuff in our calendar I guess I forgot this one. It’s a good reminder to have a system for tracking subscriptions (beyond the payment showing up on your credit card statement), and to check-in on your system every once in a while. I’m planning to run through any cyclical purchases and make sure there aren’t any other missing, unnecessary subscriptions.