Our December 2025 Budget in Percentages | Family of Four

I wrapped up November thinking our gift spending would slow down, and maybe even drop back down to pre-holiday levels, because we were done buying gifts for the kids…

No such luck. I forgot to account for the fact that our kids wanted to buy gifts for each other and a few friends, that we’d get small gifts for their teachers, and that we’d order holiday cards for family and friends. So instead of going down, gift spending actually went up. 🙃

As usual, food was one of our biggest spending categories. We treated ourselves with holiday cooking, trying recipes we don’t normally make (like fig and goat cheese pastries), hosting two families for New Year’s Eve, and feeding E plus three friends for a sleepover. We certainly ate well this month.

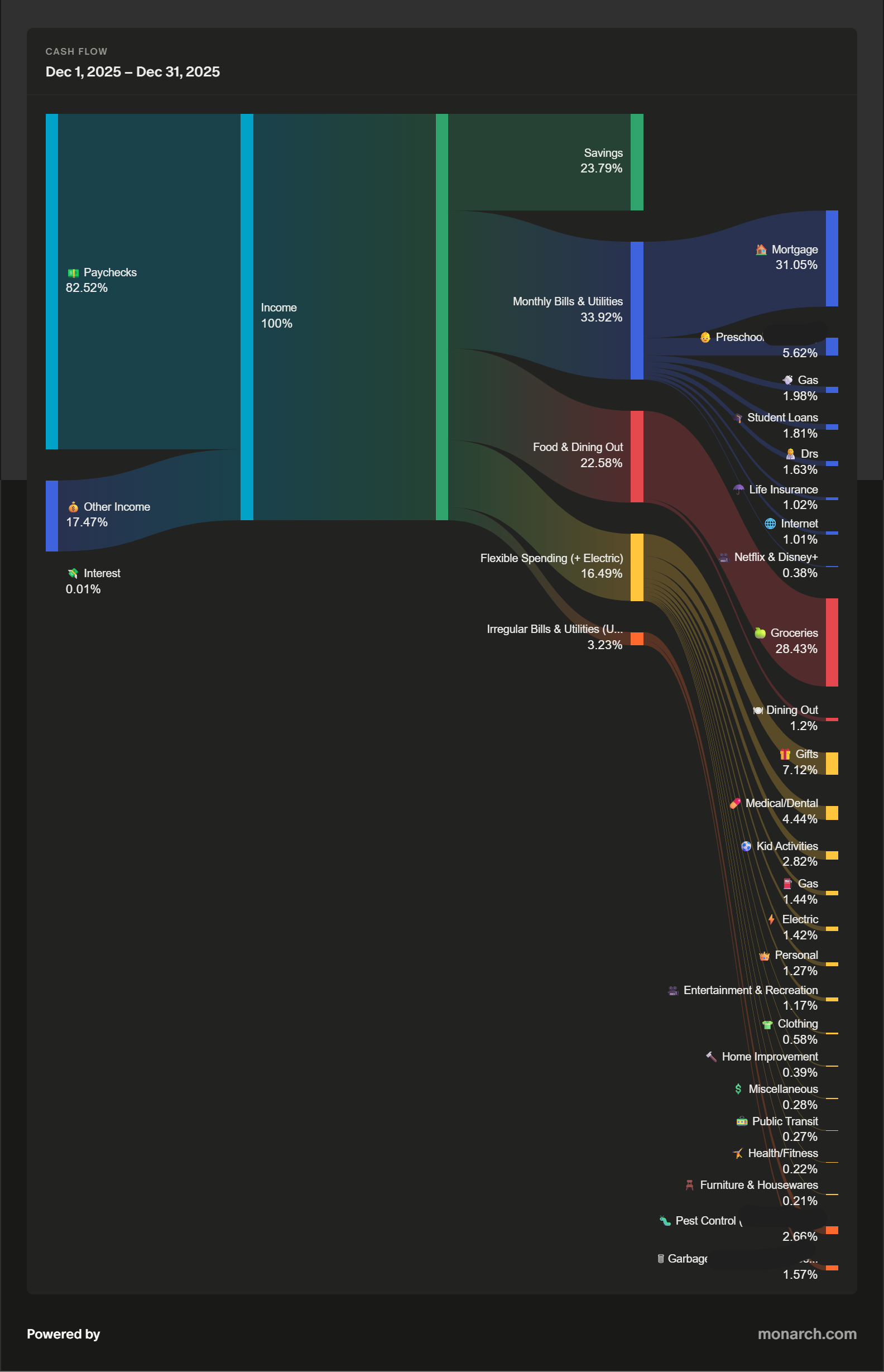

Cash Flow Overview

Our savings rate in December came in at almost 24%, which is definitely not typical for us. This higher rate reflects a couple of one-time boosts. We received a sizable cash gift for Christmas, and Mike received a generous Amazon gift card through work as part of an award. Because of that, some regular expenses didn’t make it to our checking account or onto our credit cards.

These boosts also allowed us to rebuild our checking account back to the level I like (one month of income) without pulling from savings. The remaining surplus went straight into savings.

We spent more than we intended to in two budget categories this month:

Electric: Over budget again (though only by $9). Since electric is our only truly variable utility and keeps fluctuating seasonally, I moved it into our flexible spending budget group in Monarch. That way it pulls from a larger pool of money, and I’m not forced into category-to-category shuffling each month.

Food & Dining Out: We were over by $17, which is really good considering all the hosting, special holiday foods, and snack-style gifts that were included in this area of our budget. The vast majority of this category was groceries; we only spent $66 dining out all month. I covered the overage by borrowing from flexible spending, which was under budget.

Highlights

Savings rate: 23.8%

Top spending categories:

Mortgage (31.1%)

Groceries (28.4%)

Gifts (7.1%)

Preschool (5.6%)

Irregular bills that hit:

Garbage (1.6%)

Pest control (2.7%)

Reflections & Looking Ahead

The end of the year always gets me thinking about our finances. We’re in a season that feels easier than previous ones and finances don’t feel quite so tight; however, we’re not saving as consistently as I’d like. Savings tends to happen in bursts rather than steadily, and that’s been weighing on me.

This reflection pushed me to start making a plan to contribute more intentionally to my own retirement, something I haven’t done consistently since leaving my full-time job in 2022. In January, I’ll start taking a portion of what I pay myself from my business and put it towards a Roth IRA.

I started delving into SEP IRAs vs. Solo 401(k)s, but that feels like it’s over complicating things right now. I need this to be easy and I already have a Roth IRA. Sure, it may not be the “best” or “right” path, but it’s better than nothing and I can always open another type of account in the future. This will definitely tighten our monthly budget a bit, so I’m curious to see how it feels in practice. Always a work in progress!