Our November 2025 Budget in Percentages | Family of Four

Budget wise, November was calm. After October’s surprise brake repair bill, it felt nice to have a month with no big, unexpected expenses. We also had some extra income come in through Mike’s work, which helped us rebuild our checking account buffer and cover some areas where we went over budget this month.

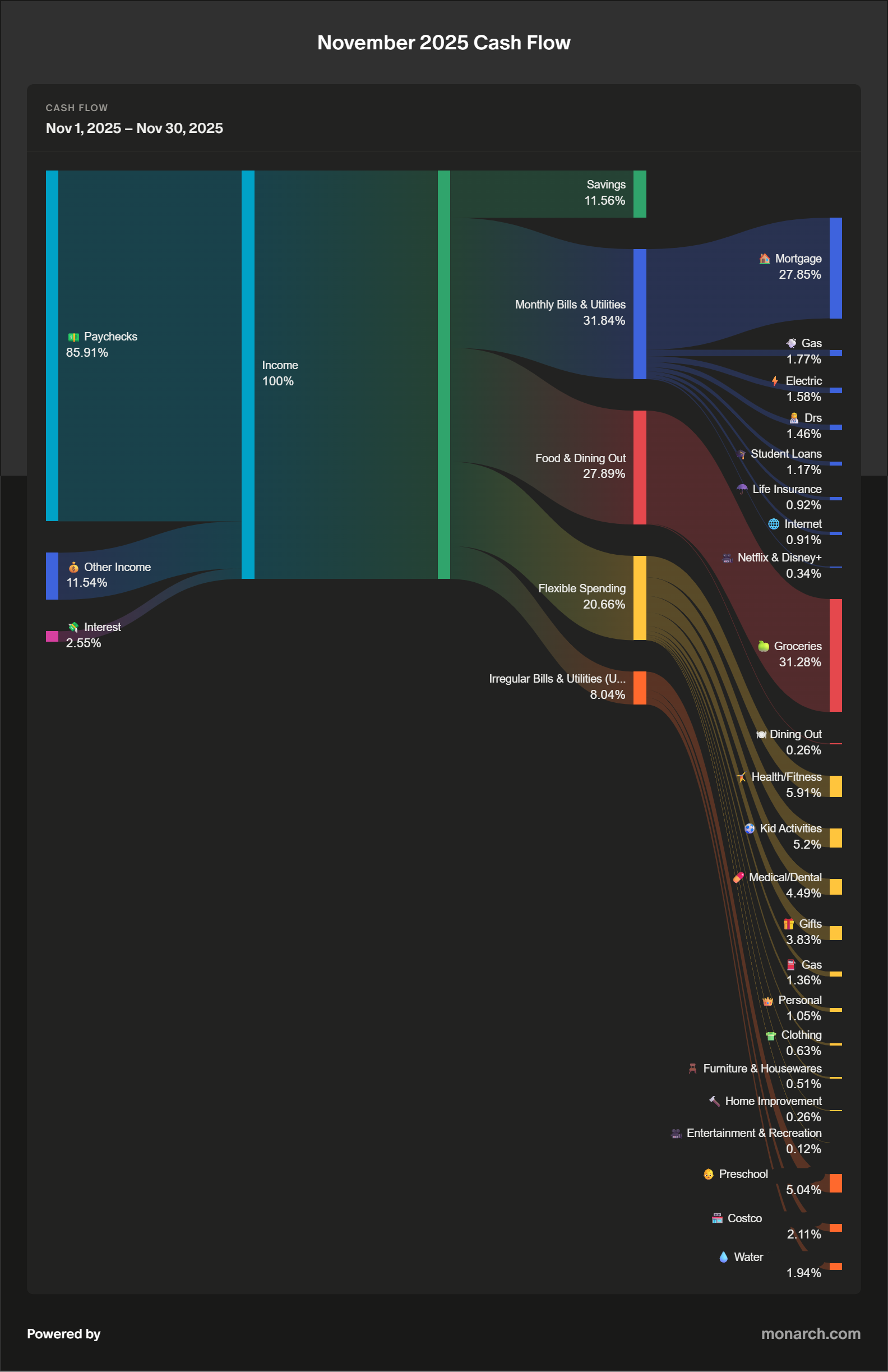

Cash Flow Overview

We saved almost 12% in November, largely thanks to a quarterly stock payout Mike receives through ~2028. The majority of that extra income went straight towards replenishing our checking account after October’s overspend.

I like to keep one full month of income sitting in checking, and we’re not quite back to that level yet, but I’m confident we’ll get there within the next month or two without tapping into savings.

Even with lower overall spending this month, we still had a few categories where we spent more than usual:

Electric bill: Slightly higher than normal again, I’m thinking I may need to revisit this amount in our budget.

Groceries: Hosting Thanksgiving, having visitors earlier in the month, and bringing a dish to a birthday potluck added up.

Health & Fitness: REP Fitness ran a Black Friday deal on an adjustable kettlebell, which we bought as an early joint Christmas gift for Mike and I. I also restocked protein powder from Be Well By Kelly during their sale.

Kid Activities: We signed E up for volleyball.

The good news: the extra income from the stock payout covered all of these overages (plus partially replenished our checking account).

Highlights

Savings rate: 11.6%

Top spending categories:

Groceries (31.3%)

Mortgage (27.9%)

Health & Fitness (5.9%)

Kid Activities (5.2%)

Mortgage and groceries are typically going to occupy the top two spots for us. Groceries came in higher than usual this month with Thanksgiving hosting, visitors, and bringing an extra meal to a potluck. Not a surprise!

Irregular Bills: Our water bill and Costco membership renewal hit this month. Budgeted amounts for all other bills went into our sinking funds savings account.

Reflections

It feels good to be slowly recouping from October’s car repair bill without pulling anything from savings. November felt… a little boring, in a good way. Predictable expenses, no major surprises, and a chance to reset.

As a small reminder to myself: delicious food doesn’t have to be expensive. Yes, our grocery spending was higher than usual, but one of the standout dishes of the month was a simple roasted garlic-parmesan broccoli. Cheap, easy, and a crowd-pleaser.

Looking Ahead to December

December brings holidays, school break, more downtime, and more events, which usually equals more spending on food and hosting. We’re planning a small NYE dinner with two other families, plus E is having three friends over for a sleepover shortly after Christmas. We’ll probably eat out at least once or twice as well.

I’m expecting groceries and dining out to bump up again in December, but gift spending should taper off now that most of our big purchases happened during the November sales. We shall see!